Consider Integration

Consider Integration

When you retire, you have the option to integrate your TRAF pension with the Canada Pension Plan (CPP), Old Age Security (OAS), or both.

The purpose of integration is to provide a more uniform amount of income throughout retirement, rather than having less income initially (prior to CPP and/or OAS eligibility) and more income in the later years (when CPP and OAS commence). Integration provides an opportunity to increase cash flow early in your retirement.

How it works

If you select integration, TRAF increases your pension payment initially and reduces your pension at age 60 and/or age 65 to collect the additional amounts that were paid to you during your earlier years.

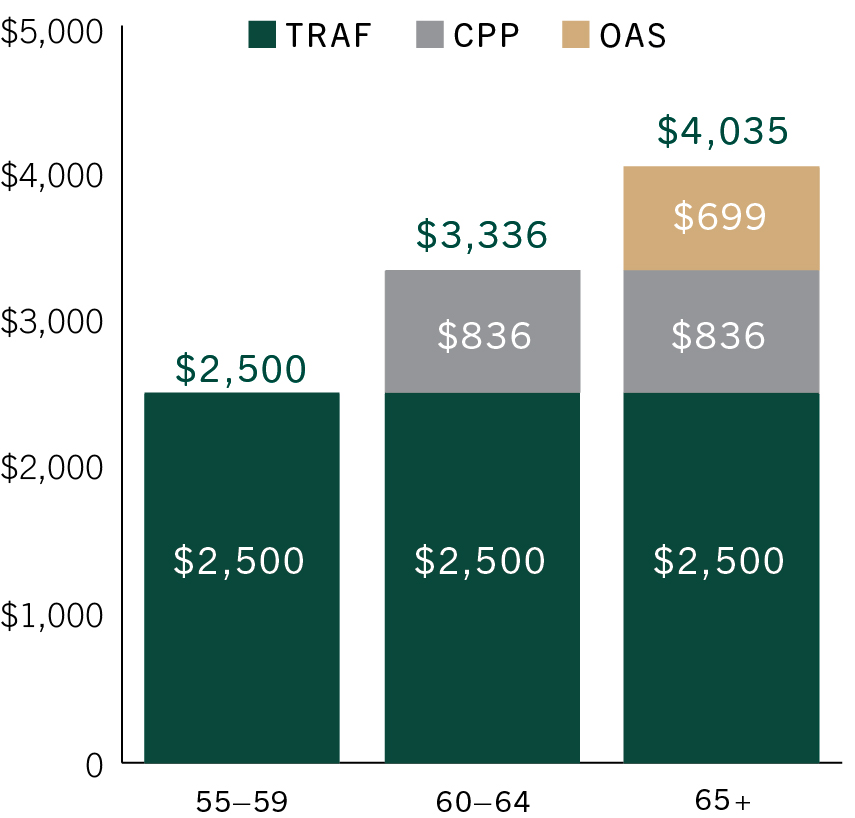

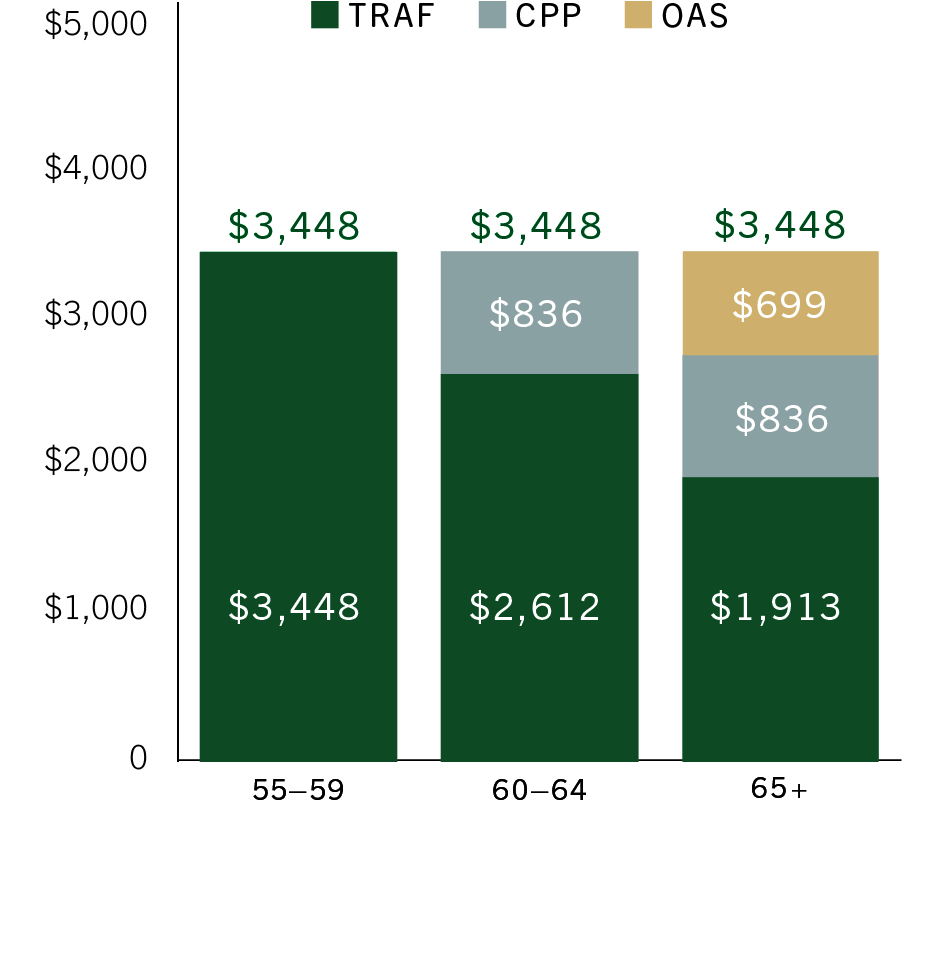

These examples assume you retire at age 55 with a $2,500 monthly pension:

Without integration

Without integration, your TRAF pension remains at $2,500 per month throughout retirement.

At age 60, if you are eligible, you can apply for CPP directly from the federal government. The combined CPP and TRAF pensions bring your monthly income to $3,336.

At age 65, you can apply for your OAS benefit to bring your total monthly income from all three sources to $4,035.

Your TRAF pension is constant throughout your retirement.

With integration

With integration, TRAF increases your pension initially to $3,448 per month and then lowers it at age 60 and again at age 65.

At age 60, the TRAF pension reduces by $836 per month. At that time, providing you are eligible, you can apply for CPP directly from the federal government. Therefore, your total monthly income, which you now receive from two sources, remains at the same level of $3,448.

At age 65, your TRAF pension reduces by $699 per month. At that time, providing you are eligible, you can apply for your OAS benefit to bring your total monthly income, which you now receive from three sources, to the same level of $3,448.

Important points

Integration is a personal choice and you need to decide whether this option is for you. Once you make the decision and your pension has started, you cannot change it.

- When you integrate, you are not receiving your CPP and OAS early; rather you are receiving an advance of your future TRAF pension. Your government benefits are paid directly by the federal government and are based on your eligibility under those programs.

- These reductions are made at age 60 and 65, whether or not you are eligible or apply for CPP and OAS. The rules relating to these benefits do change periodically, so it’s a good idea to contact CPP and OAS to confirm eligibility.

- The amounts calculated under integration are based on life expectancies; therefore, the actuarial value of the pension is the same at the time of retirement regardless of whether or not you select integration. However, if you pass away earlier than life expectancy, you will have received more than had you not integrated. If you live beyond your life expectancy, you will have received less than had you not integrated.

- If you select Plan D, you must choose between joint and single life integration. Under joint life integration, the additional amounts and the reductions for CPP and/or OAS integration will reduce to two-thirds upon either your death or your partner’s death, whichever occurs first. Under single life integration, the additional amounts and the reductions for CPP and/or OAS integration will stop at your death. With all other plans, integration is paid on a single life basis only.

Why would you choose to integrate?

- Integration provides an opportunity to increase your cash flow earlier in retirement.

- You may have higher expenses such as travel, children living at home, or a mortgage.

- You may want to delay accessing your personal investments.

- It may enable you to retire earlier.

Why would you choose not to integrate?

- You plan to work after retirement and earn additional income.

- You plan to use your Registered Retirement Savings Plan or other investments to supplement your income until you become eligible for CPP and OAS.

- You do not need the additional income.

- Integration increases your taxable income in earlier years.

How to proceed

Before you make your decision, make sure you understand how integration works including how your pension is impacted on your death or your partner’s death, if applicable.

Select whether or not you want to integrate when you complete your Pension Application. If you are married or common-law, your partner must complete the waiver included in the Pension Application. In addition, The Pension Benefits Act (Manitoba) requires that your partner provide consent by completing Form 5B – Consent for Integrated Pension. Remember, you cannot change this decision after your pension has started.

Submit your application and the required documents to TRAF at least three months prior to the date you want your pension to start and up to 12 months in advance. If you are registered for Online Services, you can apply for your pension online. Alternatively, you can contact our office for a paper copy of the Pension Application.

Additional information

If you have any further questions, contact a Member Service Representative at 204-949-0048 or 1-800-782-0714.

Contact CPP and OAS directly at 1-800-277-9914 for more information.