Choose Plan Option

Choose Plan Option

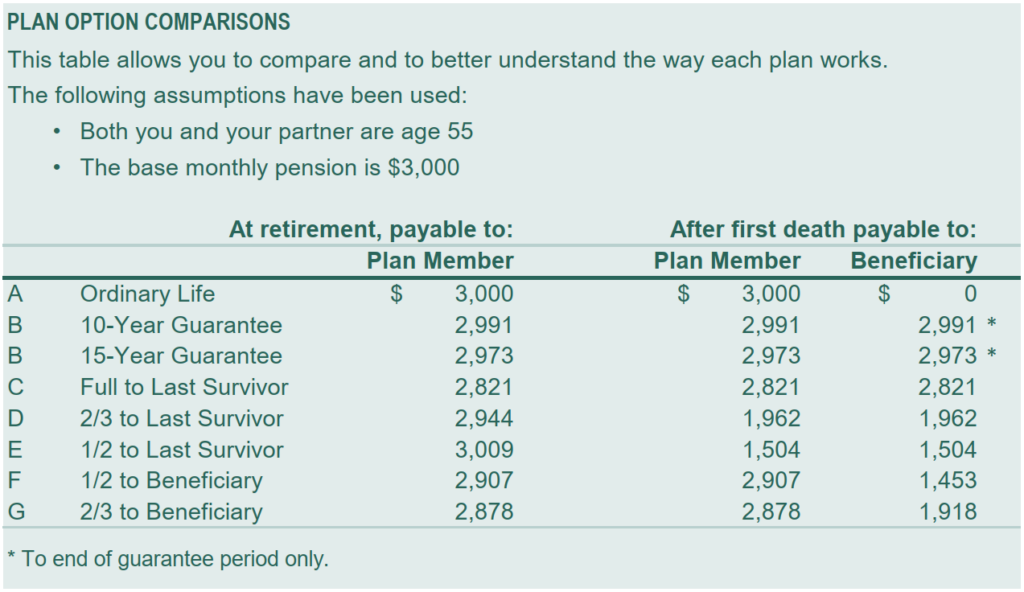

The amount of pension you receive when you retire, and the amount that is left to your surviving partner or beneficiary in case of death, varies depending on which one of the eight plan options you select.

Choosing the plan option that is best for you is a personal decision based on your specific situation and will be the most important decision you have to make before you retire. Read the details of each option below.

If you are single:

Plans A and B are available to you.

If you are married or living common-law and you and your spouse/partner* are cohabiting in a conjugal relationship at the time of your retirement:

All plan options are available to you.

- Under Plans A and B, you can designate anyone as your beneficiary.

- Under Plans C to H, your spouse or partner must be your beneficiary.

* “Spouse” or “partner” includes your married or common-law partner, provided you are not living separate and apart due to a relationship breakdown at the time you commence your pension. The term “spouse” and “partner” are used interchangeably.

Make your decision carefully as your plan option cannot be changed once you receive your first pension payment, and you cannot name a new beneficiary under Plans C to H, even if you remarry.

Plan options

Contribution and interest guarantee

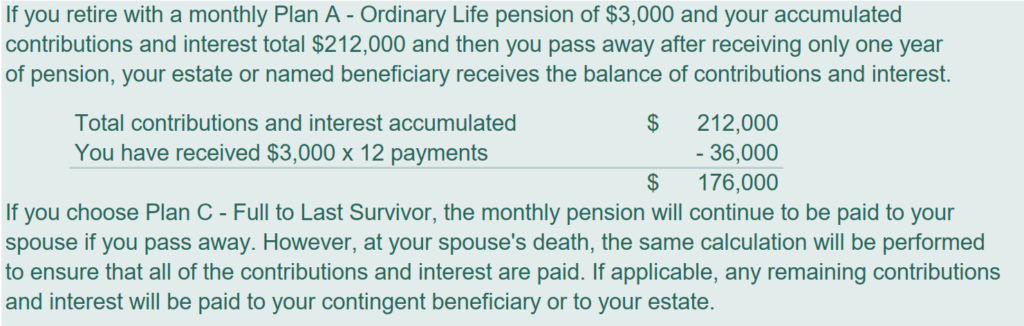

In all cases, if the pension payments made to you and your beneficiary(ies), if applicable, total less than your contributions plus compounded interest at your retirement date, the difference is refunded to your estate or beneficiary. You may wish to designate a contingent beneficiary(ies) for this purpose. Your pension contributions and interest are generally paid out within eight to nine years of collecting pension.

How to proceed

Ensure you understand how each plan option works, including how your pension is impacted on your death or your partner’s death, if applicable. Contact us if you have any questions.

Select your plan option when you complete your Pension Application.

If you are married or living common-law and you and your spouse/partner are cohabiting in a conjugal relationship at the time of your retirement:

And you select an option other than Plan D – 2/3 to Last Survivor:

- Your partner must complete the Spouse/Common-law Partner Authorization section of the Pension Application.

And you select a plan option that provides less than 60% to your partner (i.e., Plan A, B, E, F or H, if applicable):

- Your partner must waive the minimum requirement by completing and submitting to TRAF Form 5A – Waiver of 60% Joint Survivor Pension within 60 days prior to your pension effective date. TRAF will provide this form directly to your partner by mail at that time. If the required waiver is not submitted within the prescribed time limits, your pension will default to Plan D – 2/3 to Last Survivor.

Your partner may revoke the authorization and/or waiver at any time before your pension commences by providing written notice to our office.

Submit your application and the required documents to TRAF at least three months prior to the date you want your pension to start, and up to 12 months in advance (except for Form 5A – Waiver of 60% Joint Survivor Pension, if applicable, which must be submitted within 60 days prior to your pension effective date).

If you are registered for Online Services, you can fill out your pension application online before sending it to TRAF. Alternatively, you can contact our office for a paper copy of the Pension Application.