Active Members

FAQs

Online Services is quick, secure and easy to use. To register, visit Online Services and click the “Register” button. Complete the steps and click “Submit.” Your registration will be processed within two business days and then you will receive an email from TRAF that includes your user ID.

The first time you log in, you may be asked to:

- Verify your email address

- Set a new password

- Set up email for multi-factor authentication (MFA)

Learn more about how to register for Online Services and set up MFA by watching a step-by-step video or reviewing the fact sheet.

TRAF’s net investment return for 2024 was 15.48%. After the deduction of administrative expenses, the net plan return was 15.40%. Pursuant to applicable legislation, this rate of return is required to be used for a number of purposes, including the rate of return credited to the Pension Adjustment Account (PAA), the MTS Account and the MSBA Account.

If you left teaching before May 31, 2010 and have less than a certain number of years of qualifying service, which depends on when you left teaching, you can get a refund of your contributions.

If you leave teaching on or after May 31, 2010, your contributions are locked in and “vested.” As a result, a refund of contributions is not permitted.

Learn more by reviewing TRAF’s Fact sheets on leaving teaching before or after May 31, 2010.

You are entitled to the full value of your accrued pension in accordance with the pension formula. This value is generally greater than your contributions alone.

Yes, we have reciprocal transfer agreements with teacher plans in all provinces, as well as with certain Manitoba public sector employers.

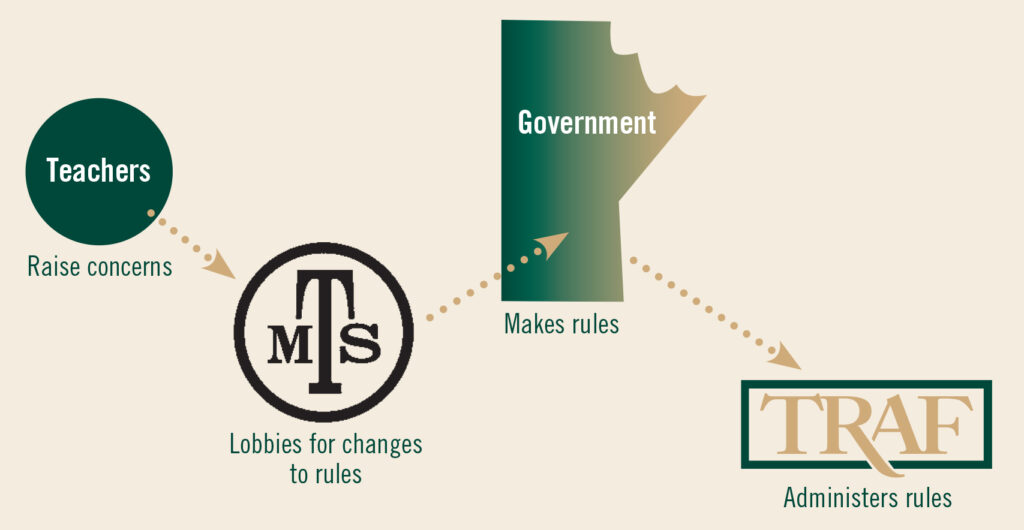

No. TRAF is a separate organization from MTS.

TRAF administers your pension plan according to The Teachers’ Pensions Act (TPA) which sets out the plan’s terms and conditions. The Government of Manitoba is the only body that can change the TPA.

Yes, you should submit a beneficiary designation to TRAF so that your file is uptodate. If you are married or common-law, your beneficiary is your spouse or partner. Log in to your Online Services account to review or update your beneficiary designation.

Contributions to TRAF are mandatory for all full-time, part-time, term and in some cases, substitute teachers. Your contributions to TRAF start the day you begin teaching under contract.

If you meet the eligibility requirements, the earliest you can collect your TRAF pension is age 55.

Income tax will generally be deducted from your payment each month.

Deductions may be taken for items such as the Retired Teachers’ Association of Manitoba membership fees.

Extended healthcare coverage is provided by organizations external to TRAF. Please contact these organizations for more information.

This is one of the most critical retirement decisions you will make. The plan option you select should be based on your specific situation. Review the plan options and talk to a TRAF Member Services Specialist who can provide you with the information needed to make an educated retirement decision.

You should consider your lifestyle, other income, expenses and the health of you and your partner when making this decision.

Once you have received your first payment, you cannot change your plan option. This is why TRAF stresses the importance of considering your options before making this decision.

You will need a completed Pension Application, a copy of your birth certificate, baptismal or citizenship certificate (and your partner’s birth certificate, if applicable), banking instructions, and TD1 forms. Other forms may also be required, depending on the option you choose. Until further notice, original and certified copies are not required. However, TRAF reserves the right to request originals or certified copies.

Registration for Online Services is a prerequisite for applying for your pension. Register today, and contact us if you have any questions.

Once registered for Online Services, you have the option to complete the Pension Application online up to one year in advance. Applying online prevents delays and ensures the process goes smoothly.

You will need to make many important decisions before you receive your TRAF pension. If you are considering retirement you should discuss with a Member Services Specialist to ensure that you understand the choices you have made.

It is also a good idea to discuss with a financial advisor.

Yes, you can. For details, see Teaching After Retirement.

To avoid an early retirement penalty (ERP), your age and qualifying service must equal at least 80, or you must be 60 years of age with at least 10 years of qualifying service.

If you are subject to an ERP, a bridging benefit will be paid until age 65 or death to offset this reduction.

Cost of living adjustment (COLA) payments are meant to help offset inflation and are granted to the extent they can be funded by a separate account known as the Pension Adjustment Account (PAA). The PAA is funded by a portion of active members’ contributions and investment earnings and is responsible for 50% of the COLA granted to eligible retired members or their beneficiaries. The Province funds the other 50% of the COLA as benefit payments are made.

The maximum amount of COLA that can be paid each year is the lesser of:

(a) the change in the Consumer Price Index for Canada – December over the previous December, and

(b) the amount the PAA can support.

Given the number of variables involved, it is difficult to predict the amount of future COLA. The plan actuary has projected future COLA to be approximately 0.85% over the next 40 years. Actual COLA is subject to annual fluctuations and there is no guarantee that a COLA will be granted every year. Annuities are not entitled to a COLA.

COLA is granted in July. You may be entitled to receive your first COLA in your 13th pension payment. In order to receive a full COLA, you must have received pension payments for 18 months prior to that COLA being granted. Otherwise, the COLA will be pro-rated based on the number of months you received a pension.

COLA will continue for any plan option that provides ongoing pension payments after the death of a member. However, the beneficiary is only entitled to two-thirds of the COLA payment – that includes the cumulative COLA from the date your pension started to the present date, as well as for future COLA granted.

You can receive your TRAF pension anywhere in the world. If you take up residency in another country, you will be subject to income tax applicable for that country.

Yes. The maximum pension benefit you can earn is equal to 70% of your average salary (subject to limits under the Income Tax Act). The number of years of service required to reach this limit will depend on your average salary. However, the average member has to teach well over 40 years before reaching the maximum pension benefit, which is 70% of their average salary.

Your pension benefit will continue to change even after this point if your average salary increases.

Consult with a professional advisor to determine if making additional voluntary contributions (AVCs) is right for you. If you determine that making AVCs fits your personal financial plan, you can apply to have these deducted from your salary. You can increase, decrease or stop your payroll deduction at any time. To make AVCs, you will need to use the Additional Voluntary Contribution Calculator to determine the amount you can contribute, then apply to have AVCs deducted from your pay. The application form is part of the calculator. Print it and submit one copy of the form to the payroll office in your school division and one copy to TRAF.

TRAF has a Member Appeal Policy which outlines a process to follow should you wish to appeal certain decisions.

TRAF offre une politique d’appel à ses membres qui explique le processus à suivre dans l’éventualité où un membre voudrait en appeler de certaines décisions.

Connect With Us

If you have any questions about your pension, get in touch. We are happy to help you over the phone or by email. If you’re considering retirement, contact us to book an appointment.