Required Contributions

Required Contributions

Who contributes?

All full-time, part-time and term employees in a position covered by TRAF must contribute to the plan.

Substitute teachers who earn more than 25% of the year’s maximum pensionable earnings (YMPE) for two consecutive calendar years are also required to contribute to the plan. Substitute teachers may elect to make contributions for employment prior to being required to contribute to the plan.

What is the contribution rate?

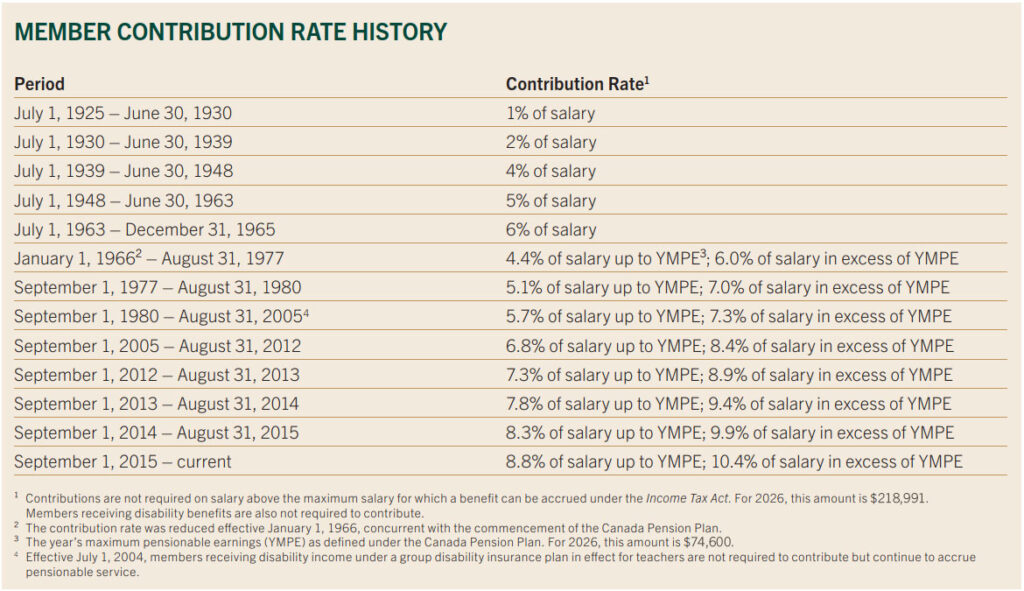

The Teachers’ Pensions Act (TPA) stipulates the amount of TRAF contributions. Currently, the salary rate up to the YMPE is deducted at 8.8% and any salary rate above the YMPE is deducted at 10.4%. For 2026, the YMPE is $74,600.

Your employer deducts these contributions from your salary.

Contributions are not required on salary above the maximum salary for which a benefit can be accrued under the Income Tax Act. For 2026, this amount is $218,991. Members receiving disability benefits are also not required to contribute.

How are TRAF contributions calculated?

TRAF contributions are generally based on the number of pensionable days paid in each month and, as a result, will fluctuate from month to month. TRAF contributions will not be required in July and August unless you are a superintendent, or an employee of the Department of Education, The Manitoba Teachers’ Society or in a position that includes paid days for July and August.

Excess contributions (50% test)

If, upon retirement, your contributions made after December 31, 1984 (less the amount allocated to the Pension Adjustment Account plus interest) are more than 50% of the commuted value of your post-1984 pension, the excess may be paid as a lump sum refund (less tax), transferred to your RRSP or added to your pension payment as a monthly annuity.

A 50% test is also calculated on death, relationship breakdown and in certain cases, termination.

Benefits and contributions with respect to service purchases, transfers under reciprocal agreements and periods while receiving disability benefits are excluded.