Account A

January 1, 2024 actuarial valuation results

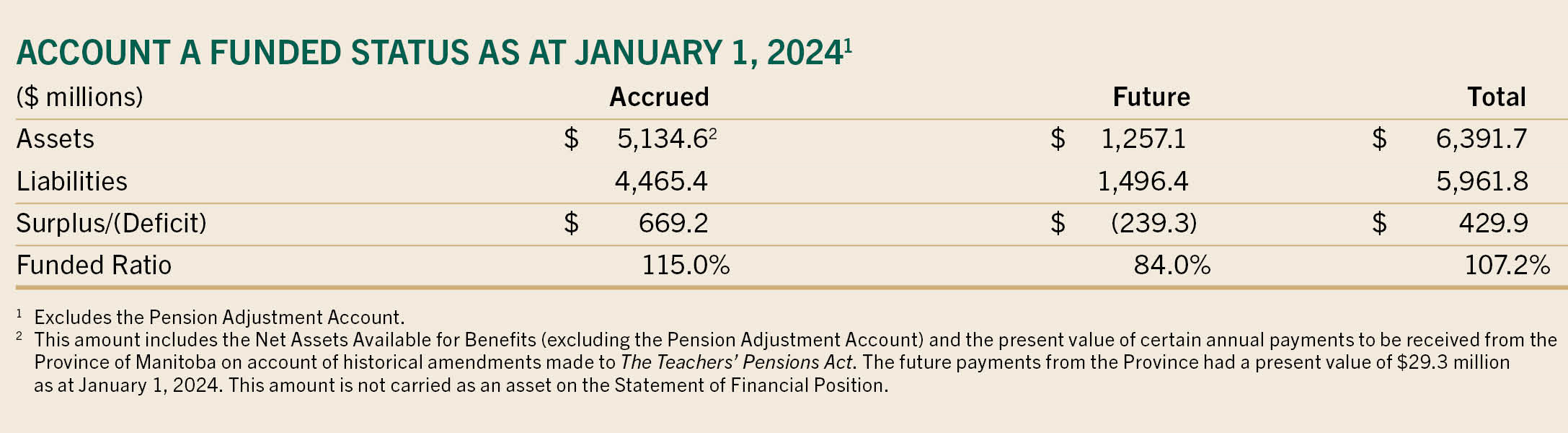

The most recent actuarial valuation of TRAF prepared by the plan actuary for funding purposes was as at January 1, 2024, which included an assessment of the financial condition of Account A. The valuation results for Account A are summarized in the following table.

The next actuarial valuation is scheduled to be performed as at January 1, 2027.

Actuarial valuations of the fund, including Account A, can be found in your Online Services account.

On a going-concern basis, as at January 1, 2024, Account A was determined to have total assets that exceeded its total liabilities, resulting in a surplus of $429.9 million (which is an improvement over the $83.6 million surplus at January 1, 2021). This equates to a funded ratio of 107.2%. It is noted that there was a surplus of $669.2 million in respect of service accrued as of the valuation date, but this surplus was offset in part by the deficit of $239.3 million in respect of future service.

Reconciliation to the prior valuation

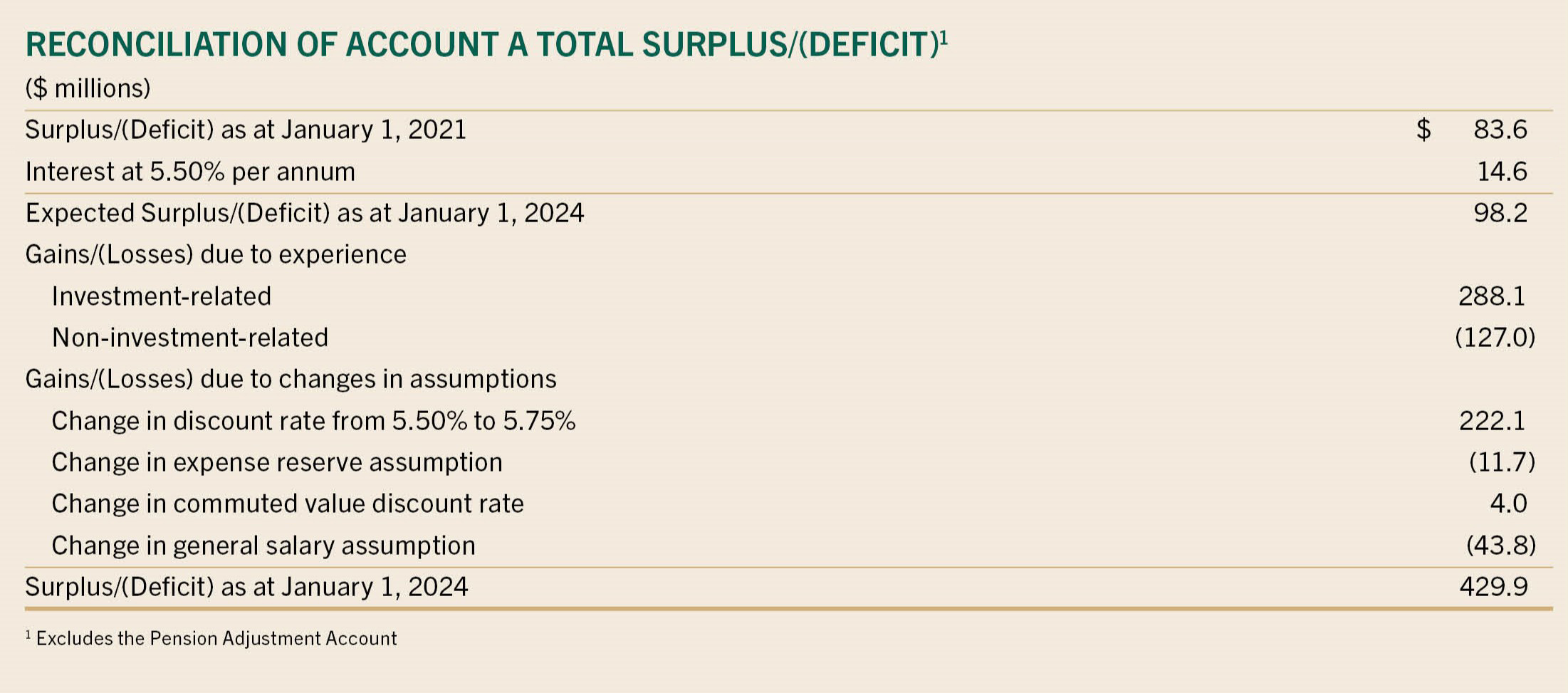

The table below reconciles the items that contributed to the Account A total surplus of $83.6 million as at January 1, 2021, improving to a total surplus of $429.9 million as at January 1, 2024.

The primary contributors to the improved funded status were the strong investment returns for the years 2021 to 2023 and the change in the discount rate assumption from 5.50% to 5.75%. The impacts were an improvement of $288.1 million and $222.1 million to the funded status, respectively.

January 1, 2025 extrapolated results

The total funded ratio of Account A (excluding the PAA) was extrapolated to be 115.0% as at January 1, 2025. This figure was based on an extrapolation of the January 1, 2024, funded status. An extrapolation incorporates actual investment results, contributions received and benefits paid since the last formal valuation. The limitations are the plan’s actual experience with respect to mortality, retirement and termination since the date of the last valuation (i.e., the extrapolation will continue to rely on assumptions for these variables). The formal actuarial valuation as at January 1, 2024, revealed a total funded ratio of Account A (excluding the PAA) of 107.2%. The funded ratio improvement was largely due to the net investment return being greater than the actuarial expected return during 2024.